With a Health Care FSA, you set aside pretax money via payroll deduction to help pay for eligible healthcare expenses. Use your FSA to save 25% or more on the things you buy every day!

WHAT IS A HEALTH CARE FSA?

A Health Care FSA is a pretax savings account that allows you to pay for essential medical, dental and vision care expenses that are not covered — or only partially covered — by your medical, dental and vision insurance plans. By contributing a portion of your payroll dollars to your account on a pretax basis, you can save from 25 to 40 percent on the cost of eligible expenses.

What is an IRS-Qualified Medical Expense?

PAYING FOR MEDICAL EXPENSES

When you enroll in a Health Care FSA with your employer, you decide how much to contribute to the account for the entire Plan Year. The money is then deducted from your paycheck each pay period throughout the year before FICA, federal and applicable state income tax deductions.

The Flex Made Easy debit card makes it easy to pay for qualified expenses. Participants are provided with a Health Care FSA debit card shortly after opening their account . You may also reimburse yourself directly from your FSA account as you incur eligible expenses. Withdrawals from the account are not taxed as long as they are used for qualified expenses.

2024 HEALTH CARE FSA QUICK TIPS

- You can enroll in a Health Care FSA if you are enrolled in a traditional major medical plan (e.g., EPO, PPO, HMO). You cannot enroll in a Health Care FSA if you or your spouse are enrolled in a qualified High Deductible Health Plan (HDHP) with a Health Savings Account (HSA)

- You do not need to be enrolled in your employer’s plan. You can be covered under a spouse’s or parent’s plan and still enroll in a Health Care FSA as long as your spouse or parent does not have a qualified HDHP with an HSA. Expenses for any of your tax dependents are eligible for reimbursement, even if they are not covered under your employer’s health insurance plan

- For 2024, the maximum annual election is $3,200. The minimum annual election is $100

- Your election is typically fixed for the entire Plan Year unless you have a qualifying life event

- The Health Care FSA is a non-interest-bearing account. You cannot invest the funds in the account

- There is a 90-day claims runout period after the end of your Plan Year for submitting claims for eligible heath care expenses incurred in the prior Plan Year. Your Plan may have a Rollover Option ($640 is the maximum rollover for plan years beginning in 2024) or a 2 ½ month Grace Per

HEALTH CARE FSA IN ACTION: MEET MEGAN!

Megan elects medical coverage for her two children and husband, Joe, who has a health condition that requires regular doctor’s office visits and prescription medication. Her youngest child will also need braces during the year.

Megan decides to contribute $200 per month to her Health Care FSA. The monthly contributions lower her taxable income resulting in a tax savings of $720 for the year and $2,400 available to her for out-of-pocket medical and vision expenses.

Gross Monthly Salary | $4,200 |

Monthly FSA Contribution | $200 |

Taxable Monthly Income | $4,000 |

Income Tax Bracket | 30% |

Tax Savings on $2,400 Annual Contribution | $720 |

Health Care FSA FAQs

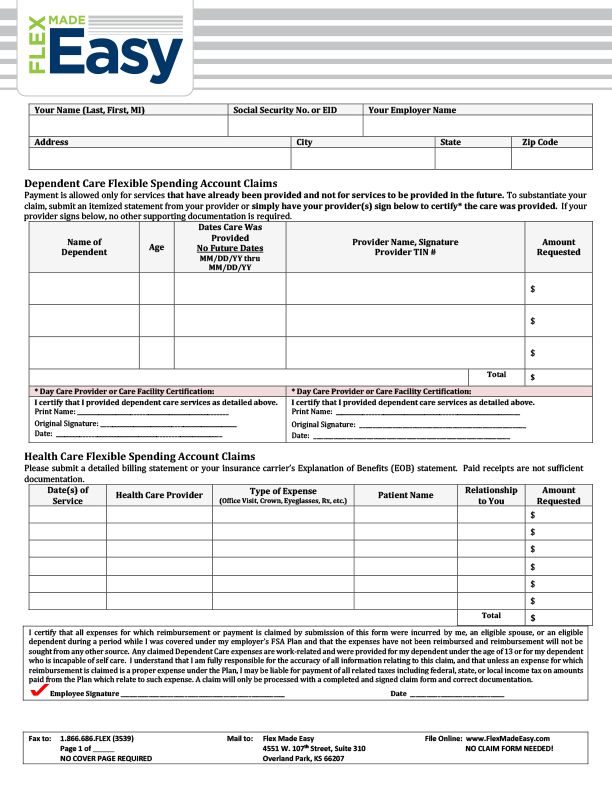

When submitting a claim, you must provide the following information:

- Name of the person who received the service (omit for retail store purchases)

- Provider who delivered the service or retail store name

- Date of service or when the purchase occurred

- Type of service or product purchased

- Amount paid for the service or product, and the portion not reimbursed through the insurance carrier

Yes. The mileage rate for travel to and from eligible health care is $0.22 per documented mile. Many online mapping services will help detail your route and mileage from home to service provider.

When submitting a claim, you must provide the following information with your mileage claim:

- Date of service

- Type of service (doctor visit, trip to pharmacy, etc.)

- Actual mileage and rate, and total reimbursement amount (e.g., 16 miles round trip x $0.22 per mile = $3.52)

Submit the information with a claim form or with the Explanation of Benefits (EOB).

You can only change the amount you are contributing if you have a qualifying life event, such as marriage, divorce or the birth of a child.

The grace period allows you additional time to spend the dollars that are in your Health Care FSA account. To find out if your employer offers a grace period, log into your account or call customer service at 1-855-615-3679.

Yes, your Health Care FSA debit card can be used during the grace period to pay for current year expenses using funds remaining in the account from the previous plan year. When those funds are exhausted, debit card payments will be made from the current/new plan year account. The grace period is only applicable for participants that are enrolled in an FSA account for the new plan year.

You may sign up for direct deposit online at FlexMadeEasy.com. After logging in, select “profile” from your plan page and follow the instructions to change your payment option to direct deposit. If you are unable to set up the feature online, please contact Customer Care at 1-855-615-3679.

Qualifying expenses are those for medical care for the participant, their spouse (if filing a joint tax return) and a qualified child or qualified relative. You may also claim medical expenses you incur and pay to medical providers of a child for whom you don’t get the tax exemption due to a divorce decree, as long as one parent claims the child as a tax dependent. (The tax exemption may switch from year to year between parents. As long as one parent gets the tax exemption, the medical expenses you pay on behalf of the child to the medical provider qualify under the Health Care Flexible Spending Account.)

No. IRS rules stipulate that you must submit a detailed statement of services from an independent third party (such as your insurance company or your medical provider) to substantiate your reimbursement request. Proof of payment is not required, and, by itself, is not sufficient documentation to support your reimbursement request.

These expenses may qualify, depending upon your individual situation. The IRS allows for a tax break for expenses you incur in order to treat a current or imminent medical condition. For example, if you are taking calcium to treat osteoporosis, then this would be an eligible expense. If you are taking calcium to prevent osteoporosis, then the expense would not be eligible.

In order to claim these items, you are required to have your medical provider complete a Letter of Medical Necessity that verifies the expense is eligible.

Generally, you are not allowed to modify your election amount after the plan year has started, unless you experience a qualifying event. Examples of qualifying life events include:

- Getting married or divorced, or having a change in employment status for you or your spouse

- Having a change in the number of dependents through birth, placement for adoption, or death of a dependent

Please check with your Human Resources department if you have questions or concerns.

After you have set up your account, you will receive two cards in the name of the enrolled participant.

Your card will be funded with your full, annual election on the first day of the plan year or your first day of coverage if you sign up mid-year.

Present the debit card for payment when you are asked to pay your bill. The card can only be used for eligible expenses, and will only be accepted at medical vendors or at grocery stores and pharmacies that have implemented an IRS-approved Inventory Information Approval System (IIAS). Most retail outlets selling prescription drugs and eligible over-the-counter items have implemented IIAS.

As you use your debit card during the year, you may receive requests from Flex Made Easy for supporting documentation of a transaction. All payments from a Flexible Spending Plan must be confirmed to be in accordance with IRS regulations.

Our system can often automatically approve transactions that are for prescription drug expenses or office visit copays.

For other transactions we need to receive supporting documentation to confirm two things:

- The date of service with within the Plan Year

- The transaction is for an eligible expense.

The documentation can be an itemized statement from the provider listing the date of service, a description of the services provided and the amount charged. We can also accept the Explanation of Benefits (EOB) from your insurance company.

If you know you are going to have a recurring charge for the same dollar amount from the same provider throughout the Plan Year, please let us know. Once the first transaction is documented, we can update our system so all future transactions will be approved. A common example of a recurring transaction is the monthly fee for orthodontia expenses.

You can submit the required documentation (or file a claim for reimbursement) through your on-line account or the mobile app. You can also submit by email to info@flexmadeeasy.com or fax to 866-686-3539.

The Health Care FSA is pre-funded from the first day of the Plan Year. That means your total annual election is available immediately. The Health Care FSA works like an interest free loan to pay a large eligible expense you may have at the start of the Plan Year. For example, if you make an annual election of $1,200 ($100 payroll deduction per month) and you have a large eligible expense of $1,000 in the first month of the Plan Year, you will be reimbursed the full $1,000 even though you have only contributed $100. Your monthly deductions of $100 will continue for the entire Plan Year.